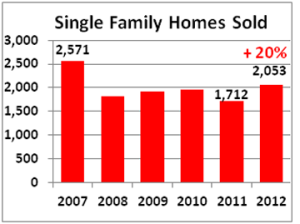

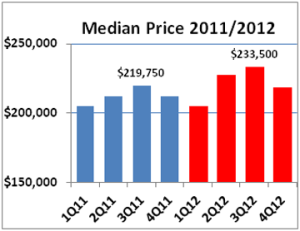

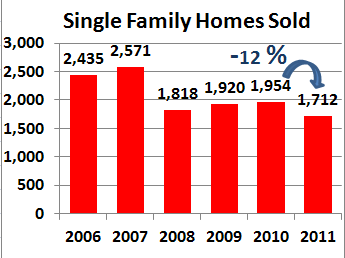

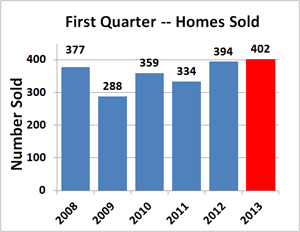

Sales of single family homes improved slightly in the first quarter vs. the same period last year, continuing the upward trend in sales that started in 2012.

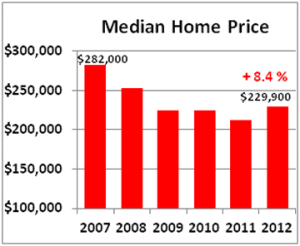

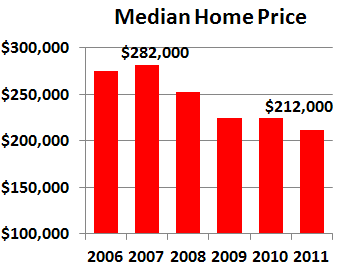

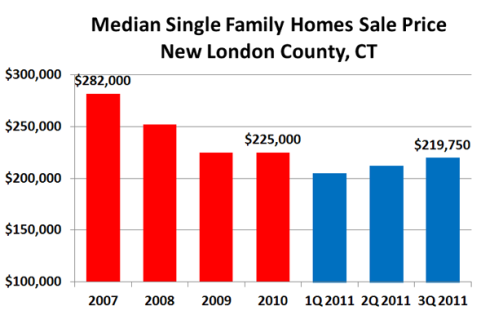

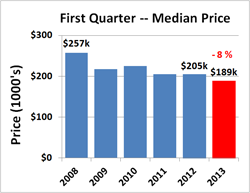

Median home prices for the quarter dipped by about 8% vs 2012, possibly due to the long, cold winter in New England that’s finally releasing its grip.

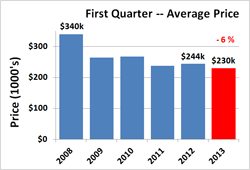

Average home prices dipped to $230,414, losing about 6% compared to 1Q12. Small declines like this are common this time of year, and we can expect prices to strengthen as the spring and summer selling seasons hit top speed.

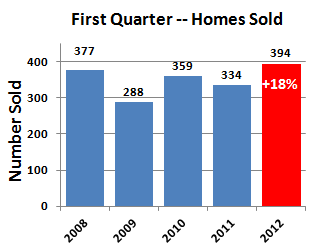

The really encouraging figure this quarter is the number of homes sold that’s slightly better than last year. In 2012, we finally saw signs that the market was strengthening with sales improving by 20% over the local market bottom of 2011.

With demand on the rise and supply lower than recent years, prices are likely to improve in 2013.

SF Homes Sold 1Q12: 394

SF Homes Sold 1Q13: 402 (+2%)

Median price 1Q12: $205,000

Median price 1Q13: $189,500 (-8%)

Average price 1Q12: $244,182

Average price 1Q13: $230,419 (-6%)

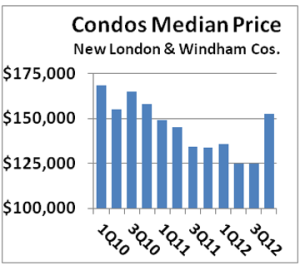

What’s Going on with Condos?

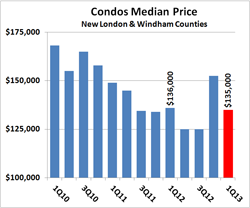

In the 4th quarter of 2012, the median price for condos spiked by 20%, and I’m pretty sure that hiccup was a temporary artifact of the small number of units sold. Last quarter, the median price was back to a more believable $135,000, or an increase of 8% over last summer’s prices and on par with summer 2011 prices.

Ignore the 4Q12 outlier or at least take it with a grain of salt.

Still, median prices are up, and starting to look like there might be a trend on the horizon.

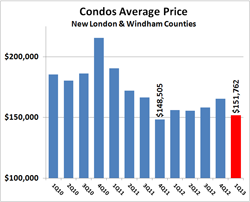

Average condo prices held steady and have been essentially flat for six straight quarters. At least we don’t seem to be losing any more ground.

Condo prices tend to recover more slowly after a bubble than single family home prices, so this is historically consistent.

Number of units sold 1Q13: 51

Median condo price 1Q13: $135,000

Average condo price 1Q13: $151,762

FHA Certifications Slipping Away?

FHA certifications for condo complexes are expiring at an alarming rate. Realtors® and lenders are aware of this trend, yet no one seems to have a good explanation as to the reasons why.

Buyers qualified for FHA loans can’t buy into a complex unless the condo association is pre-certified by FHA. It’s estimated that FHA now insures about 40% of all mortgages.

Expired FHA certification means the buyer pool for your condo is 40% less than it should be.